12 Simple Things That Treacherously Push Us Towards Needless Spending

We often promise ourselves, before doing the weekly shopping, to only buy the things we need and strictly stick to the shopping list. However, we still end up coming home with much more. Often people spend extra money thanks to successful marketing. But other factors, such as drinks or weather, can also influence our impulsive behavior. Luckily, unnecessary spending can be prevented.

A seemingly innocent cup of coffee can lead to serious spending.

A recent study has found that consumers who indulge in a cup of coffee or any other liquid containing caffeine, end up leaving a handsome sum at the checkout. Such drinks increase energy levels, elevate the mood and encourage people to stock their carts with frivolous items, such as scented candles, perfumes, chocolates, and other things associated with pleasure. Scientists next plan to research what effect the combination of caffeine and a sweet dessert or loud music, can have on people.

A difficult financial situation does not incite the will to start saving money.

We often buy unnecessary things to reward ourselves for a job well done or for a serious achievement. A bonus given at work can inspire us to spend too much. However, a difficult financial situation can have the same outcome.

A team from Hertfordshire University found that in economic crises, women are more likely to make rash purchases and leave larger sums at the supermarket than in stable times. Worries about lack of money bring people down, so they’re likely to use shopping as a way to lift their spirits.

It’s best not to go shopping with old bills in your wallet.

It turns out, that our behavior can be influenced by the appearance of money. New and clean bills evoke positive emotions, but dirty and wrinkled ones make us want to get rid of them quickly. People don’t like to keep old, shabby notes in their wallets, which have already been handled by many. Researchers at the University of Guelph found that carrying such money encouraged customers to spend recklessly and take unnecessary risks.

Sometimes it’s cheaper to pay for the delivery when shopping online

It may seem that we spend considerably more time in real shops than we do shopping online. But actually, it’s on the internet that customers spend longer choosing and researching different offers. Many look at the products in physical shops first, and then go online, reading reviews and comparing offers.

In addition, we leave more money in online shops than in physical ones. Such establishments often offer free delivery but apply a minimum spend, which encourages us to buy things we don’t need. On top of that, special software evaluates our online behavior and suggests exactly those products on which we might be more willing to spend money recklessly.

Hot and sunny weather can lead to frivolous spending.

Temperature, humidity, atmospheric pressure, and rainfall, all influence our shopping choices. These factors determine not only what we buy, but also the amount we’re willing to spend. On sunny days, people leave considerably more money in the shops than on overcast ones.

Heat prevents us from concentrating and thinking critically when shopping. When the temperature on the sales floor is high, people find it difficult to choose between products, and to effectively assess their pros and cons, so they’re more likely to spend money on well-known and advertised brands, even if the product doesn’t meet all requirements, and isn’t very useful or convenient.

If you’re not a morning person, that’s actually the best time to go shopping.

It turns out, it’s no coincidence that we choose the same familiar foods for breakfast, but prefer variety for dinner. As Jonah Berger’s research shows, most people don’t feel completely awake in the morning, so they don’t want to bother looking for new and interesting products at the shop at this time of day. In the evening, however, when activity picks up, they’re ready to buy something unusual and unexpected.

The exception here is the “early birds” who wake up at the crack of dawn, cheerful and alert. The rest of the shoppers, though, will stick to familiar items in the first half of the day, and spend more time searching for “something different” in the second half.

Before going shopping, it’s worth picking the right playlist.

Shopkeepers and restaurant owners think about the music that plays in their establishment, as it can have a significant impact on customer behavior. Fast tempos make people move more quickly, which means it’s good for fast food establishments, but it’s bad for in-store profits.

Quiet and relaxing music encourages customers to spend more time browsing, while loud songs make them want to leave more quickly. The genre also matters, with classical music and jazz inspiring us to spend more and buy more expensive products. If you want to save money on shopping, it’s best to take your headphones to the shop and listen to something upbeat and rhythmic.

We’re likely to spend more money in shops with dimmer and softer lighting.

Bright, intense lighting lifts our spirits and makes us move faster. But shoppers are less likely to want to linger around browsing or to pick up something extra. Dim and warm lighting, on the other hand, puts us in the right mood for impulse shopping. We’re slower to walk down the aisles, which leads to more spending on various things that aren’t always necessary.

Simple fragrances affect customers more than complex ones.

We rarely pay attention to scents in a shop unless they give rise to unpleasant associations. That said, the use of different scents can influence shoppers to spend more money. Research has shown that cinnamon, basil and citrus scents are relaxing, while mint and rosemary are invigorating.

Not all pleasant smells work in the same way. Simple fragrances are more effective than complex ones. Scientists suggest that the brain identifies simple smells more quickly, and easily creates pleasant images associated with them. Orange or pine scents, without any additional fragrances, can increase sales by 20%.

Looking at friends’ photos on social media can lead to unexpected spending.

Active social media users can blame these very communities for their frivolous spending habits. If a person spends a lot of time browsing their friends’ profiles, their self-esteem may rise. But, the same factor also leads to impulse purchases after stepping away from the Net. As a result, people with a large number of friends in their feeds sometimes show low self-control and a poor credit history.

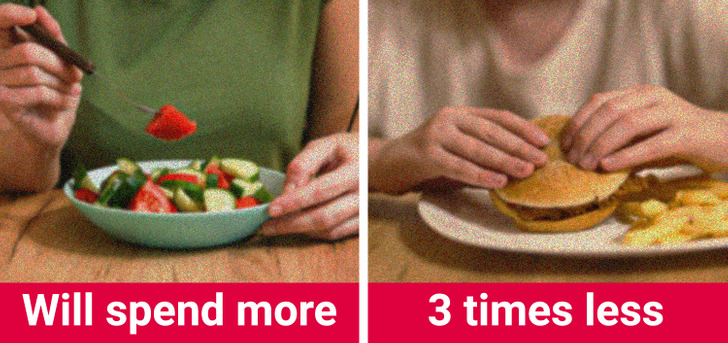

Having to stick to a diet can lead to impulsive shopping.

When we’re sticking to a strict diet, or limiting ourselves in other ways, our energy is focused on self-control in that particular area. This makes it much harder for us to focus and not give in to impulse buying at the shop. A study carried out at the University of Minnesota found that people who had to practice strict self-control for a limited time ended up spending almost 3 times as much money on shopping afterward.

It’s worth having cards that aren’t linked to the Pay app on your phone.

These days, many people prefer to pay with a special app on their phone, instead of using cards, and not to mention, cash. It’s much more convenient, as you don’t have to carry around a heavy wallet and pull out money to make a purchase. This simplicity, however, results in unnecessary spending.

We don’t get the time to think about whether we actually need what we want. As a result, we spend more money in shops and cafés, buying little things like coffee and takeaways. That’s why it’s worth setting reminders on your app, or not linking all your cards to it.

Bonus: how to stop yourself making unnecessary purchases

If you don’t want to spend money on unnecessary and useless things, first, determine what type of shopper you are: impulsive or cautious. The former usually buy something to make themselves happy, or out of curiosity. The latter take considerably more time to decide, but they also find it harder to resist temptation.

A small note in your wallet or another prominent place may be enough to quell temptation. For the first group of people, a simple “STOP” will do. The second group will need a more detailed message, such as: “No unnecessary shopping”.

When do you usually spend money on unnecessary things? Do you have your own ways of combating frivolous spending?